Articles in Money Matters

College isn’t the solution for the racial wealth gap. It’s part of the problem.

Je’lon Alexander is a Morehouse Man who graduated in 2018. He has roughly $55,000 in debt, even after a $15,000 annual scholarship. His parents, who have advanced degrees and close to $400,000 of debt between …

100 Must-Know Statistics About Race, Income, and Wealth

Income and wealth disparities along racial lines have repercussions for all aspects of life in the U.S.: education, health, homeownership, retirement, and life expectancy.

Racial inequality in the United States has many dimensions, but one of …

What successful people have in common?

The below list was lifted from Quora and is authored by Adam Fayed Founder of Global Online Financial Advisory Firm. I really like this list a lot. I think just successful is enough though – …

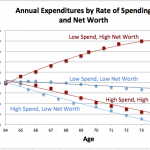

The Really Surprising Thing People Get Wrong In Retirement

Saving money can be difficult. But spending it? That part was supposed to be easy for retirees who’ve spent decades building up their nest eggs for their golden years.

Source: The Really Surprising Thing People Get …

When should you retire? Don’t die at your desk

Fritz Gilbert knew in his 20s that he did not want to die at his desk. Gilbert, 55, who retired last week, started saving decades ago for what could be one of our most fraught …

How to live it up without going broke before you die

I know how to save. It’s in my DNA.

Spending, now that’s a challenge. My dog chewed away part of the cushion on the inside of one of my shoes. You can clearly see his bite …

4 steps to prepare for a secure retirement

I enjoy almost every aspect of cooking, from finding recipes to plating. (In fairness, does anyone really enjoy cleaning up afterward?)

I spend about 45 minutes planning, preparing, and plating a meal that takes my family …

Meet Vicki Robin, the FIRE Early Retirement Community Idol

Vicki Robin literally wrote the book on retiring happy.

Vicki Robin had no idea she’d become a millennial icon.

The 72-year-old coauthor of the 1992 bestseller Your Money or Your Life was recuperating from a hip replacement …

How to Retire on $500K In Your 50’s or 60’s

Yes, it’s possible to retire on $500K in your 50’s and 60’s. Here’s how to do it safely and stretch your dollars as much as possible.

Question: Is it possible to retire on $500K (i.e. $500,000) …

Where Are We in ‘The Cycle’?

When viewed through a business-cycle lens, the current economy is showing signs of both mid- and late-cycle dynamics.

Source: Where Are We in ‘The Cycle’?

My Comments: A really good primer on the business by Karen Wallace …

Start planning now to care for elderly parents

If you have an aging parent and want a glimpse of what the future holds, look no further than Leslie Glutzer.

The 66-year-old from Chicago has a mom who is 92, dealing with dementia, now living …

How to put a dynamic retirement spending strategy in place

Welcome to retirement at the beginning of the 21st century: People are living longer, return expectations are muted for the foreseeable future, and employer-funded pension plans are becoming a thing of the past. This is not …

Should You Make IRA Contributions After 65?

As I was listening to my voicemail on a Saturday morning, I picked up a message from a relative. “Christine, I have some extra money to invest,” she said. “I put some cash into my …

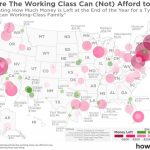

The Working Class Can’t Afford the American Dream

The national conversation in the U.S. is focused squarely on improving the lives of people in the working class. The debate revolves around exactly how to do that. Politicians and pundits have all sorts of …

Here’s what health care will cost you in retirement

My husband and I were dreaming about what we would do if we won the recent $758 million Powerball jackpot. (We didn’t.) I told him he should keep working his federal government job so that …

Your Financial Life Is Complicated; Your Portfolio Shouldn’t Be

The uptake of index products has been widely hailed as an expression of investors’ preference for low-cost investments. And a quest to lower total portfolio costs and cut out higher-priced, underperforming funds may well be …

Straight from Vanguard retirees: 6 retirement-planning tips

In my last post, The coulda, shoulda, woulda behind every retirement story, I asked for comments. Who better than soon-to-be retirees and recent retirees to share lessons learned about preparing for retirement, right? (Exactly right.)

The record-setting …

One millennial’s advice to peers on saving for retirement: Don’t live by FOM

If you’ve saved a lot for retirement, do you have any regrets about what you may have given up to achieve your financial security?

Last week, a reader, who is not a millennial, asked what if …

The huge cost new parents may be overlooking

Some expecting parents may forget to prepare for what will likely be their biggest expense when the baby arrives: child care.

When asked how much they think it costs to raise a baby, 54 percent of people planning …

Death Is Inevitable. Financial Turmoil Afterward Isn’t.

Preparing for the death of a spouse or partner and its ramifications may be an unhappy task, but doing so can ease some avoidable financial sorrows.

MOST of us do not even want to contemplate the …

Welcome back debt! Total household debt rose by $63 billion

The appetite for debt is now back in a furious way. Total household debt was up $63 billion last quarter driven largely by auto loans. Auto loans increased by $32 billion and the amount of …

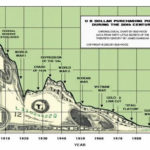

The story of inflation between 1996 and 2016

Inflation is rarely discussed in the mainstream press. Most people wake up every day and simply believe that prices go up as a natural state. These deeply held assumptions usually crack when new revelations happen …

Sustaining retirement income in a lower-return world | Vanguard Blog

The first place to start in a low-return environment would be to minimize your investment costs.

Every day, I seem to have a discussion with someone regarding strategies for sustaining retirement income in a lower-return world. Investors, …

Want college to pay off? These are the 50 majors with the highest earnings.

Many of the highest-paying entry-level jobs are tied to engineering and technology majors.

Engineering and technology are among the most challenging fields of study in college, but all of that hard work apparently is paying off, …

Millennials are bogged down by massive student debt and confiscatory housing prices

Millennials are a critical group in terms of where the economy goes in the next few years. The economy largely relies on younger people to spend and purchase consumption items. Think of a young couple …

Securing an Early Retirement: The Blogosphere’s 7 Best Lessons

You can retire safely when you have 25x your annual expenses invested in income generating assets

At a time when many struggle to save enough for a comfortable retirement, there are a few people who …

Look Out! Retirement Mistakes are Easy to Make

As a Certified Financial Planner for Personal Capital, I see too many people who focus on their present financial situation or the few years that lie just ahead. They don’t “look out” to what seems …

Retirement Lessons Learned From Botching Savings Early In My Career

At every career stage, it’s all too easy to get caught up in the excitement of new money and forget about re-evaluating your retirement plan.

As we start, grow, and end our careers, our focus shifts …

Why black workers who do everything right still get left behind

We’ve known for a while that black Americans aren’t making economic progress. A recent report from the Economic Policy Institute, a left-leaning think tank, shows that the black-white wage gap is now the widest it has been since 1979. What’s more …

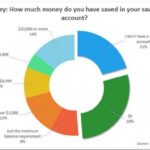

With a recovery like this, who needs a recession: 62 percent of Americans don’t even have $1000 in savings.

The stock market just hit another record high. Yet only half of Americans actually own any stock. Real estate prices are ebbing closer to their previous bubble peak. Yet the homeownership rate is down. The …