by Rupe | Sep 8, 2011 | Money Matters

There are few more wrenching events in life than losing your spouse.

There are few more wrenching events in life than losing your spouse.

But to make matters worse, the death of a life partner also unleashes a torrent of financial tasks. And more often than not, it is a woman — a widow — who is taking them on.

Women live longer than men, and they’re likely to outlive their male spouses, given that decades ago, many women married men a few years older. Plus, gender roles being what they were, men often took on most of the household finances.

Click source link to read full article…

Source: New York Times

My Comments:

This is a key area I don’t think most couples give much attention to until it is too late. I think each couple, in fact, each person should be prepared to pick up the pieces if they lose a partner. It is not just prudent planing…it is downright smart.

by Rupe | Sep 8, 2011 | Money Matters

PARENTS want to raise their children to be independent and successful and to use whatever resources they have to give their offspring a leg up in life.

PARENTS want to raise their children to be independent and successful and to use whatever resources they have to give their offspring a leg up in life.

But it’s sometimes difficult for parents to find the right balance between making financial and professional resources available and encouraging their children to grow into independent adults. I have written a lot over the years about the counsel that parents seek to help them do this. A whole industry now exists around “next generation†advice and about how to “launch†children into adulthood.

And let’s be honest: if affluent parents were not anxious that their children could end up as alcoholics, say, or plagued by bad decision-making, this industry would not exist.

Click source link below to read the full article…

Source: New York Times

My Comments:

Great article about passing wealth on to your kids…a good read.

by Rupe | Sep 8, 2011 | Money Matters

My experience tells me that people who want to be rich are the first ones who get taken advantage of in investment scams. Â And the same thing happens in debt relief scams. Â The thieves are just waiting with promises of fast results. Those promises are exactly what these folks want to hear so they only to happily fork over their hard-earned cash. In most every case, these exchanges end up costing these people everything.

My experience tells me that people who want to be rich are the first ones who get taken advantage of in investment scams. Â And the same thing happens in debt relief scams. Â The thieves are just waiting with promises of fast results. Those promises are exactly what these folks want to hear so they only to happily fork over their hard-earned cash. In most every case, these exchanges end up costing these people everything.

So my best advice to you if you’re interested in investing like rich people is to focus on building wealth and do it one day at a time.

Click source link to read full story…

Source: Wealth Pilgrim

My Comments:

Neal is one of my must reads each week. He is a financial advisor that knows his Sh@#. This is a really great article that speaks to the seeking of wealth. It is a must read if you care about growing wealth…not just being rich. Yes, there is a difference…!

by Rupe | Sep 3, 2011 | Money Matters

If you do borrow, time is no longer your best friend Money grows over time, everyone knows that. And if you are investing regularly, time is truly your best friend. I’ll take a known statistic for example. Most of the time, your money doubles every eight years on average. For someone who is investing and not tapping into their 401k plans like a savings account, this is great news. However, if you withdraw money from your 401k plan you are missing out on serious growth opportunities. There are many reasons people take 401k loans, but many Americans take out money for a mortgage. 401k rules allow for these loans to be taken out for up to 5 years, and up to 15 years for a home purchase. If you borrow from your 401k, you are missing out on opportunities for your money to grow among other things. Over the long haul, this could mean the difference between $50,000 and $500,000. I don’t know about you, but I don’t want to miss out on the potential long-term growth prospects for my retirement money.

If you do borrow, time is no longer your best friend Money grows over time, everyone knows that. And if you are investing regularly, time is truly your best friend. I’ll take a known statistic for example. Most of the time, your money doubles every eight years on average. For someone who is investing and not tapping into their 401k plans like a savings account, this is great news. However, if you withdraw money from your 401k plan you are missing out on serious growth opportunities. There are many reasons people take 401k loans, but many Americans take out money for a mortgage. 401k rules allow for these loans to be taken out for up to 5 years, and up to 15 years for a home purchase. If you borrow from your 401k, you are missing out on opportunities for your money to grow among other things. Over the long haul, this could mean the difference between $50,000 and $500,000. I don’t know about you, but I don’t want to miss out on the potential long-term growth prospects for my retirement money.

Click source to continue…

Source: GenxFinance

My Comment:

I must admit I have been tempted to do this to settle things with my mortgage company and break off the relationship, but this article has given me pause.

by Rupe | Aug 28, 2011 | Mad Musings, Money Matters

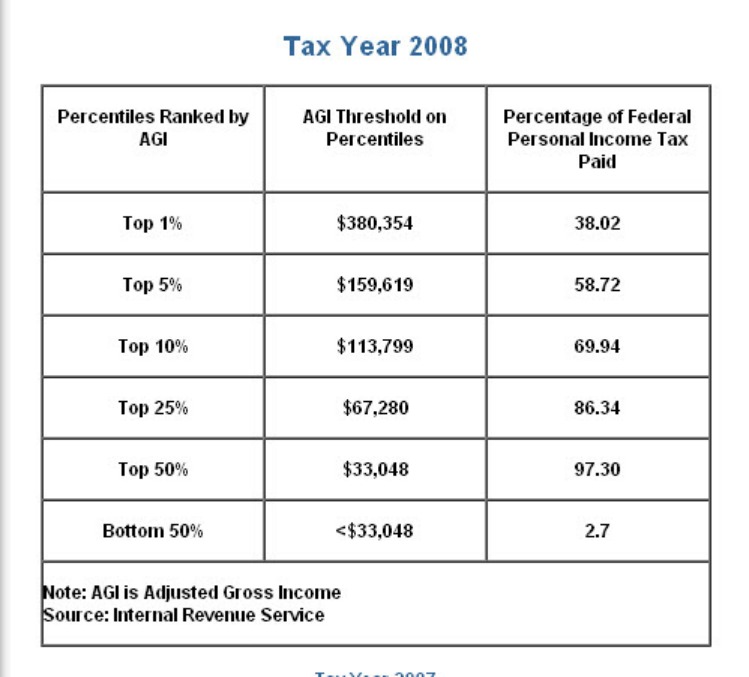

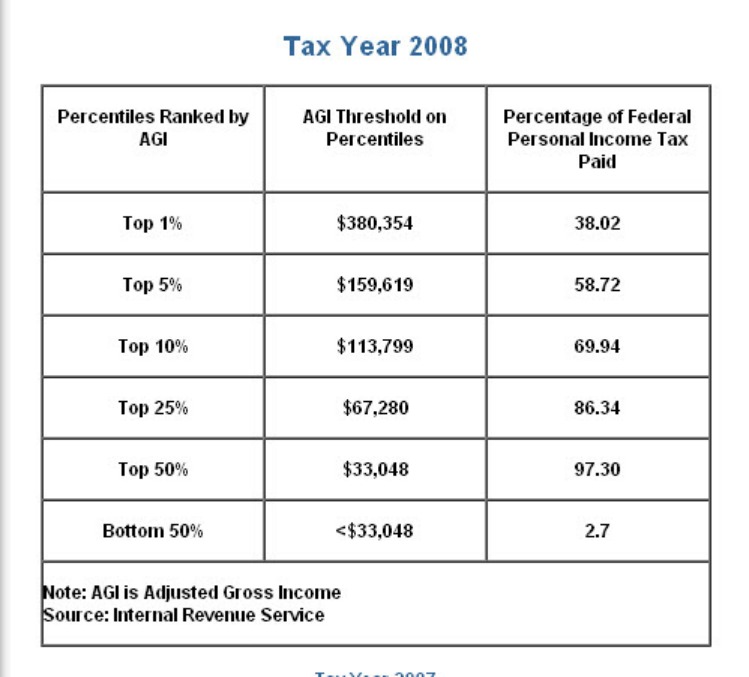

Click for larger graphic

The Government is on a desperate search to put as many shekels as it can in it’s coffer. Is raising taxes on the rich the answer?

Most people don’t think so. AP conducted a poll to find out what the best solution was for the deficit problem. 62% think the government should cut spending. Only 20% think the solution is tax hikes. Also, in a recent Investor Business Daily poll, 92% of Americans think it’s important to cut government spending. If we want to put something away for our future or start saving money for a house, we have to make changes to our spending.  Shouldn’t the government do the same?  Many of think they should.

But “we†might be wrong. Maybe “we†just don’t understand. Let’s take a look at the numbers to determine what the best course of action might be.

Continue reading by clicking source link below…

Source: WealthPilgrim

My Comments:

Another conflicting topic for me. Â 50% of the population pays almost 100% of the taxes seems somewhat unfair, but there are many ways to cut this cookie, and while I have quite a bit to say on that, I won’t go into it here. Â I think the government isn’t particularly doing a good job with the cash it takes from us, and while a large percent of taxes the overall taxes collected comes from the top 1%, believe, they are barely feeling it; as all indicators show that the gulf between the rich and poor is growing ever wider.

by Rupe | Aug 28, 2011 | Military-Political, Money Matters

It sounds like a pretty good deal: Retire at age 38 after 20 years of work and get a monthly pension of half your salary for the rest of your life. All you have to do is join the military.

It sounds like a pretty good deal: Retire at age 38 after 20 years of work and get a monthly pension of half your salary for the rest of your life. All you have to do is join the military.

As the nation tightens its budget belt, the century-old military retirement system has come under attack as unaffordable, unfair to some who serve and overly generous compared with civilian benefits.

That very notion, laid out in a Pentagon-ordered study, sent a wave of fear and anger through the ranks of current and retired military members when it was reported in the news media this month.

Continue reading by clicking source link below…

Source: Military.com

My Comments:

Hmmm…I am honestly slightly conflicted by this…. I absolutely would agree with a 401k type solution with a few more additionals. Â I think the current system of not providing much support for servicemembers who have served for less than 20 years is unfair. Â I don’t support support drawing parallels to civilian systems, it simply is not equivalent. Â And I do believe that Congressional Retirement benefits should be changed before we touch the military’s.

There are few more wrenching events in life than losing your spouse.

There are few more wrenching events in life than losing your spouse.